In today’s fast-paced digital world, where technology evolves at an unprecedented rate, financial institutions face numerous hurdles in keeping up with the demands of their customers while maintaining a competitive edge.

One significant aspect that has contributed to the advancements in IT support within financial services is the reduction of the skill gap worldwide. We’ve witnessed a remarkable transformation in the global IT landscape in recent years. As technology education and training programs have become more accessible and comprehensive, the skill gap that once hindered progress has gradually diminished. This progressive trend has had profound implications for the financial sector, making it an opportune time to explore the influence of IT support on innovation and growth.

The decreasing skill gap worldwide has presented financial institutions with a crucial decision: to outsource or augment their in-house IT teams. This choice has become increasingly pivotal as businesses strive to balance cost-effectiveness and acquiring specialized expertise. Throughout this blog, we will analyze the factors influencing this decision-making process and explore the benefits and considerations associated with outsourcing and team augmentation.

Within financial services, practical IT support extends beyond mere technical assistance; it offers a remarkable opportunity to add “real” value across departments. By leveraging the power of technology, financial institutions can streamline their operations, enhance customer experiences, and unlock new avenues for growth. In addition, integrating IT support across various departments fosters a collaborative environment where innovative ideas can thrive and transform how financial services are delivered.

As technological innovation changes, IT support has become indispensable for driving innovation and fueling growth within the financial services industry. From revolutionizing customer experiences to bolstering cybersecurity defenses, these reasons illuminate the transformative potential of IT support and its impact on the ever-evolving landscape of banking and finance.

What Exactly Does IT Support for Financial Services Mean?

In today’s digital age, information technology (IT) plays a crucial role in the prosperity and development of financial services organizations. IT support for financial services encompasses various services and technologies designed to enhance and streamline operations, improve customer experience, and fuel innovation. Let’s delve into the definition of IT support for financial services and explore how it can drive innovation and growth.

IT support for Financial Services is defined as:

IT support for financial services refers to the specialized assistance, infrastructure, and expertise provided by IT professionals to financial institutions, such as banks, insurance companies, investment firms, and credit unions. It encompasses various services, including hardware and software management, compliance management, network security, data analysis, system integration, cybersecurity, and technical support.

How does the distinction between augmenting internal teams and outsourcing ultimately play out?

Regarding IT support for financial services, organizations have two primary options: augmenting internal teams or outsourcing completely. Your company will ultimately need to decide based on identifying these contributing factors:

1. The level of control required: Augmenting internal teams allows organizations to retain direct control over their IT operations, enabling them to align technology initiatives with their specific business objectives. On the other hand, outsourcing provides access to external expertise and resources, allowing organizations to focus on their core competencies while leveraging IT service providers’ specialized knowledge and capabilities.

2. The ability to scale and be flexible to changing requirements: Augmenting internal teams may provide greater agility and responsiveness to rapidly changing technological needs. However, outsourcing can offer scalability and flexibility by leveraging the service provider’s infrastructure and personnel to meet evolving demands more efficiently.

3. The cost accrued for running and maintaining the IT infrastructure: Augmenting internal teams involves upfront investments in hardware, software, and human resources, as well as ongoing maintenance and support costs. Conversely, outsourcing can save costs through economies of scale and predictable pricing models.

4. Resource allocation and resource-related investments: Augmenting internal teams requires organizations to allocate resources, including time and budget, to recruit, train, and retain skilled IT professionals. On the other hand, outsourcing can free up internal resources, allowing organizations to redirect them toward other strategic initiatives.

5. Vendor management, collaboration, and oversight: Augmenting internal teams entails direct control and supervision of IT vendors, which can require dedicated resources and expertise. Outsourcing shifts the responsibility of vendor management to the IT service provider, allowing organizations to focus on their core business functions while benefiting from vendor collaboration and expertise.

5 Reasons Why IT Support for Financial Services Revolutionizes the Sector

IT support is pivotal in driving innovation and fueling growth in today’s highly competitive and rapidly evolving financial services sector. Financial institutions that leverage IT support services gain a significant competitive edge by revolutionizing their operations.

Here are five key reasons why IT support for financial services is essential for revolutionizing the sector:

1. More Profound Focus on Business-Critical Functions

IT support for financial services brings deep technical expertise across domains such as cloud computing, infrastructure management, cybersecurity, data engineering, management, and governance. By partnering with IT support providers, financial institutions can offload the burden of managing complex IT infrastructure and operations, allowing them to redirect their focus and resources toward core business-critical functions.

With the support of IT experts, financial services institutions can enhance other critical areas such as product innovation and engineering, marketing, and customer service. In addition, the proficiency and direction provided by IT support services pave the way for improved operational efficiency, enhanced customer experience, and accelerated growth.

2. More Agility, Better Adaptation to the Market

In the dynamic and volatile market scenario, agility is crucial for financial services organizations to stay ahead of the competition. IT support services bring advanced technological expertise that enables institutions to respond swiftly to market changes and evolving customer demands.

The scalability of IT infrastructure is another critical aspect offered by IT support services. For example, financial institutions can quickly scale their IT resources up or down to meet fluctuating demands, ensuring optimal performance and cost efficiency.

By embracing IT support services, financial services organizations can cultivate agility, adaptability, and responsiveness, enabling them to thrive in the ever-changing market landscape.

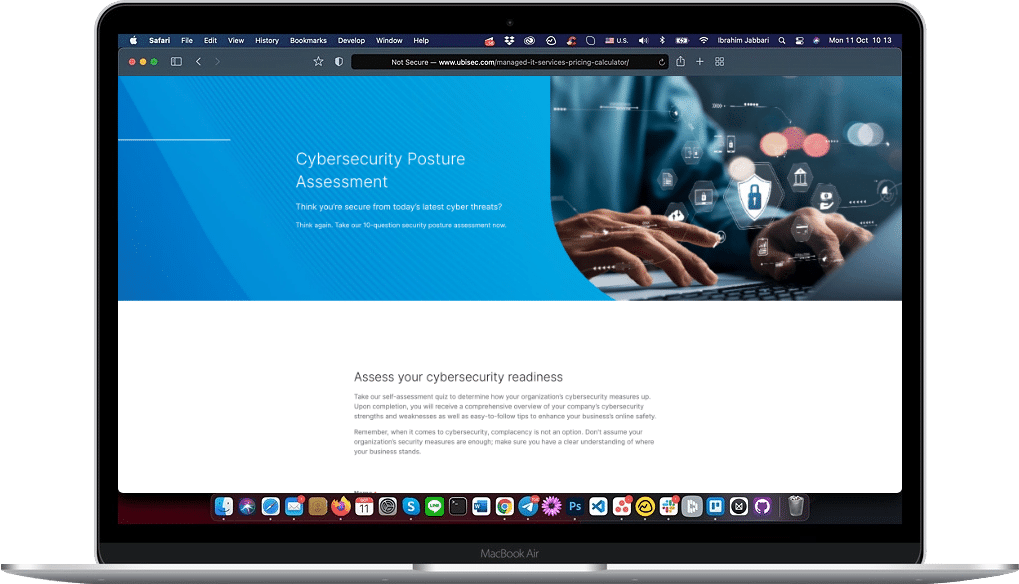

3. Improved Infrastructure Security & Compliance

In today’s digital age, the risks associated with data breaches and cyber threats are more significant than ever, especially for companies operating in the financial sector. Financial institutions handle sensitive information, making robust infrastructure security and compliance crucial. As a result, IT support for financial services plays an essential role in safeguarding the infrastructure.

The Cost of Data Breach 2022 report by IBM highlights the severe financial implications of data breaches. As a result, it’s essential to prioritize data protection and compliance with evolving regulatory requirements. IT support services provide the expertise and tools to establish and maintain robust cybersecurity measures.

Financial institutions can ensure compliance with regulations and data protection laws by partnering with IT support providers. These professionals stay updated with the latest requirements and implement security measures such as backup and recovery solutions, cloud and endpoint security, intrusion prevention systems, and more. Robust cybersecurity measures mitigate the risk of data breaches, protect sensitive customer information, and safeguard the financial institution’s reputation.

4. Reduced Burden, Higher Productivity

Augmenting in-house teams with external IT support expertise brings numerous benefits, including improved innovation and operational capabilities. In addition, by leveraging the knowledge and experience of IT professionals, financial services organizations can enhance their team’s skill sets and access specialized expertise in various technology areas.

IT support services effectively address IT issues, minimizing disruptions and making employees’ lives in other financial departments much more manageable. As a result, it’s so much easier for employees to concentrate on their core responsibilities without being hindered by technical obstacles outside their area of expertise.

Furthermore, partnering with IT support providers helps establish clear definitions of in-house teams’ roles and responsibilities. This partnership between IT support and in-house teams reduces operational fragmentation, streamlines processes, and enhances overall productivity. By removing the need for employees to deal with IT tasks beyond their expertise, they can devote more time and energy to their primary responsibilities, driving efficiency and growth within the organization.

The reduced burden and increased productivity from IT support services contribute to a more streamlined and effective operational environment. As a result, financial services institutions can optimize resource allocation, improve collaboration between departments, and achieve better outcomes in terms of innovation, customer service, and overall business growth.

5. Cost-efficiency

One of the significant advantages of IT support for financial services is its ability to drive cost efficiency. Whether a business can augment its in-house team or completely outsource the IT function, implementing IT support services can lead to substantial cost savings.

Here are several areas where IT support contributes to cost efficiency:

1. Costs saved on IT support and maintenance: By partnering with IT support providers, financial institutions can take on the responsibility of managing and maintaining their IT infrastructure. Depending on an IT support provider eliminates the need for expensive in-house IT departments, hardware investments, and software licenses. In addition, outsourcing IT support services allows organizations to leverage the expertise of specialized professionals at a fraction of the cost compared to maintaining an in-house team.

2. Costs saved on personnel training: Technology is constantly evolving, requiring employees to receive continuous training and skill updates. IT support eliminates the requirement for training and upskilling in-house staff, as external experts are responsible for staying updated with the latest advancements. As a result, financial institutions can redirect training budgets to other critical areas while ensuring their IT systems benefit from the latest technologies and best practices.

3. Cost saved from reduced hardware failures, network outages, application issues, and application downtime: IT support providers offer proactive monitoring and maintenance services to pinpoint and address potential issues before they escalate into costly problems. Regular maintenance and prompt resolution of IT issues minimize the risk of hardware failures, network outages, and application downtime.

4. Costs saved from improved team productivity: IT support services enhance productivity within financial services organizations. When IT systems run smoothly and issues promptly resolve, employees can focus on their core tasks without disruptions. The resulting increase in productivity translates into cost savings and better utilization of human resources.

5. Costs saved from the business’s ability to scale the team and infrastructure up and down based on the market: IT support services provide flexibility in scaling IT resources based on market demands. Financial institutions can quickly ramp up or down their IT capabilities as needed, aligning their infrastructure with business requirements. This scalability ensures optimal resource allocation and cost efficiency, especially during periods of growth or contraction.

By leveraging IT support services, financial services organizations can significantly reduce operational costs while maintaining high IT performance and reliability. In addition, these cost savings can be reinvested in other business areas, such as innovation, research, and customer experience enhancements, fostering overall growth and competitiveness.

How Can Ubisec Help?

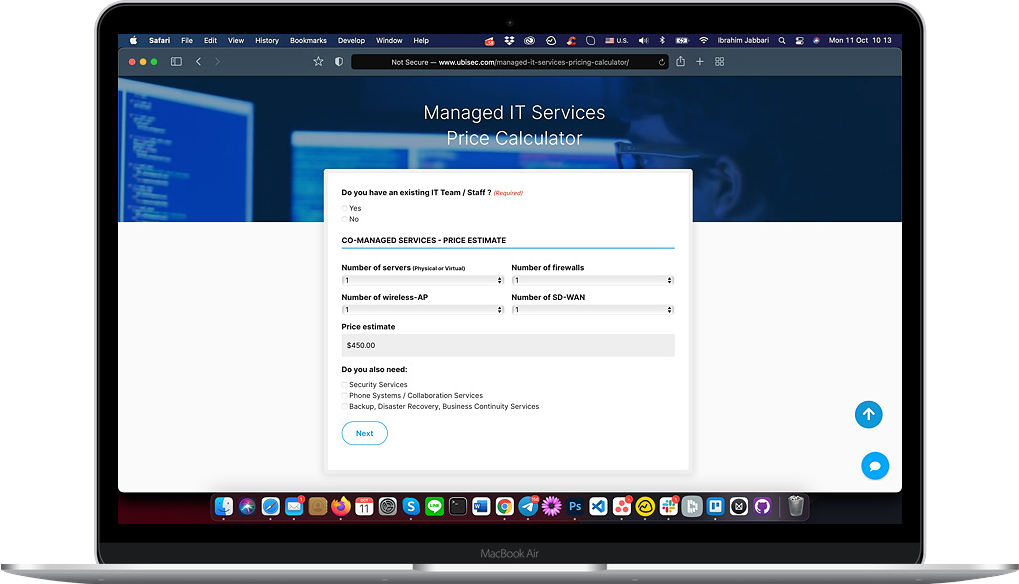

Ubisec is a leading provider of IT support services that specializes in serving the unique needs of the financial services sector. With our comprehensive range of capabilities, we enable financial institutions to leverage IT support, drive innovation, and stimulate growth across various areas in their business.

Here are just a few ways we could help you with your overall business objectives:

1. More Profound Focus on Business-Critical Functions:

Ubisec understands the importance of business-critical functions in the financial services industry. We allow financial institutions to redirect your focus and resources towards these core functions by overseeing the IT infrastructure and operations. In addition, our profound technological expertise in cloud computing, infrastructure management, cybersecurity, and data engineering enable you to optimize IT systems and support critical areas such as product innovation, engineering, marketing, and customer service.

2. More Agility, Better Adaptation to the Market:

Ubisec recognizes the need for agility in the rapidly changing financial services market. With our advanced technological expertise, we help you respond swiftly to market dynamics and evolving customer demands. Our solutions enable reduced time-to-market for products and services, facilitating better customer engagement and competitive advantage. In addition, we specialize in cloud technologies, making data exchange more accessible and providing scalable IT infrastructure to adapt to changing market conditions.

3. Improved Infrastructure Security & Compliance:

Security and compliance are essential in the financial services industry, and we excel in this domain. We offer robust cybersecurity solutions, including backup and recovery, cloud and endpoint security, and intrusion prevention systems. By partnering with us, you can ensure compliance with evolving regulatory requirements and data protection laws. In addition, our expertise in infrastructure security and compliance helps safeguard sensitive information and mitigate the risks associated with data breaches.

4. Reduced Burden, Higher Productivity:

Ubisec’s IT support services relieve financial institutions of the burden of managing your IT systems, resulting in improved productivity. We enhance your organization’s innovation and operational capabilities by augmenting in-house teams with their external expertise. As a result, we’ll handle your IT issues effectively, ensuring that your employees in other financial departments can focus on their core responsibilities without disruptions. In addition, we facilitate clear role definitions and reduced operational fragmentation, streamlining processes, and optimizing productivity.

5. Cost-efficiency:

Ubisec understands the importance of cost-efficiency for financial services institutions. Our IT support services help decrease operational costs in various ways. By outsourcing IT support and maintenance to us, you’ll save costs for maintaining an in-house team and infrastructure. Additionally, our proactive monitoring and maintenance services minimize expenses related to hardware failures, network outages, and application issues. Our expertise and scalable solutions enable you to optimize IT resources, reducing overall costs while maintaining high performance.

By partnering with Ubisec, you can leverage your capabilities across all the areas above, driving innovation and growth while ensuring a secure, agile, and cost-efficient IT environment.

We’d love to help you get started. Click here to learn more.