Section 179 stands as a formidable ally in the tax landscape, offering discerning businesses the power to deduct costs related to sanctioned hardware and readily available software. In the realm of IT purchases, the Section 179 deduction is steadily gaining prominence, and you may find yourself eligible for substantial tax benefits when investing in business-centric software and equipment.

As the year draws to a close, it is incumbent upon organizations to engage in meticulous financial planning, particularly with regard to any remaining end-of-year resources. Whether your budget retains untapped potential or significant upgrade endeavors loom on the horizon for 2024, this juncture offers an opportune moment to strategize and acquire essential equipment. Furthermore, bear in mind the IRS’s tax inflation adjustment for 2023, standing at approximately 7.1 percent, as you chart your fiscal course in safeguarding your digital assets.

What Is Section 179?

Section 179 of the Internal Revenue Code (IRC) of the United States performs a quick cost deduction that business owners can obtain for purchases of depreciable business equipment rather than financing and depreciating the asset over time. The Section 179 deduction is available if the equipment is purchased or financed and the entire purchase price qualifies.

Taking the cost of the equipment as an instant expenditure deduction helps the company to get a quick cut on its tax bill, whereas capitalizing and depreciating the asset provides for lesser deductions over a more extended period. The Section 179 expensing method is provided as an incentive for small-business owners to expand their operations by purchasing new equipment.

Section 179 Specifications and Software Purchases

Businesses can deduct purchases of off-the-shelf computer software. Off-the-shelf software is available for purchase by the general public and is not specially built.

The deduction also applies to Software-as-a-Service (SaaS), enterprise resource planning (ERP), and customer relationship management (CRM) applications. The deduction may also apply to solutions suited to specific functions (e.g., human resources, healthcare, legal, and accounting).

The discount does not apply to custom software built particularly for your firm. Significantly modified software will also not qualify.

- The code also specifies the intended life and use of the software.

- Businesses must utilize it for revenue-generating tasks more than half of the time.

- Software must have a “determinable useful life” to be depreciable.

- All purchases should last more than a year to qualify.

Which Technological Products Are Eligible for the Section 179 Deduction?

The following technological products are eligible for Section 179 deduction:

- New machinery: Workstations, servers, backup devices, hard drives, phone system gear, etc.

- Previously owned equipment: Any of the equipment mentioned above that has been reconditioned or resold

- Commercial software: Publicly available software that has yet to be specially designed. You must use the program to generate money and expect it to be used for at least a year.

Types of Software You Can Deduct

You can deduct various software types based on your firm’s type. Their usage and development determine categorization, and if you are familiar with the Section 179 tax laws for computer software, you should be able to calculate your tax deduction.

Leased Software

A software lease enables long-term equipment leases with no upfront costs. In a conventional leasing agreement, the lender (the lessor) funds the software, while the firm (the lessee) utilizes it.

Remember that leased software may not be deductible in the years before the computer program’s allocability. Furthermore, the IRS may apply unique regulations if the leased product has rental charges above $250,000. If this occurs, you may inquire more with them about lease-related issues.

Purchased Software

Purchasing software, often known as procurement software, is a type of business software that helps businesses to automate their complete source-to-pay cycle. Users may have comprehensive control over every procurement process function, from evaluating and controlling spending to managing contracts and making invoice payments.

Section 179 allows the whole cost of computer software to be deducted if filed in the year it is put into service. In other words, you must deduct it immediately, at the end of the current tax year, rather than after it has had a lengthy and “useful life.”

Company Developed Software

Whenever software is classified as “developed,” it is created within the company — i.e., the firm did not buy it; instead, it produced it. The developer will face no financial risk if the software fails to perform successfully in the market because it is their property, therefore, the market is irrelevant.

If the criterion is met, the bonus depreciation applies to software development expenditures in the next tax year. However, when bonus depreciation is unavailable, the taxpayer may deduct research expenditures in another way.

How Can Section 179 Be Applied to Software?

In practice, section 179 applies to POS systems, software, and professional services (whether SaaS or on-premises) as follows:

- If you buy or finance software in 2023 and fulfill the standards, you might deduct up to $1,160,000 from your gross income.

- Most enterprises will not exceed the $1,160,000 Section 179 limit, and bonus depreciation issues are low.

- If your purchase exceeds this limit, you can use the 80% bonus depreciation in 2023 to make up the difference.

- The $1,160,000 Section 179 limit will remain in effect for the 2023 tax year; however, bonus depreciation will begin to taper out to 80% for qualified property placed in operation in 2023.

- Section 179 applies to a perpetual software license (hosted or on-premises) and the professional services required to operate it.

Section 179 Deduction Caps and Spending Limits

- Deduction cap: $1,160,000

- Spending limit: $2,890,000

According to Section179.org, the expenditure cap is the maximum amount spent on equipment before the Section 179 deduction available to your firm is lowered on a dollar-for-dollar basis. Section 179 deduction is ineligible for larger organizations that spend more than $4,050,000 on equipment.

How Much Would Anyone Deduct for Software?

Although computer software expenses can still be deductible, remember that they are classified as “MISC Deductions.” As a result, one can deduct just what exceeds 2% of your AGI. That is the minor deduction you can take.

Keeping this in mind, if you complete all the conditions, you could deduct up to $1,050,000 of the acquisition price from your company’s gross income. If the program costs more than this amount, you can claim a 80% bonus deduction instead.

Take advantage of the Section 179 tax deduction with Ubisec

However small or large your business, there’s a good possibility you could make impressive savings by taking advantage of the Section 179 tax deduction. At Ubisec, we can help you make the right software and hardware decisions to get the most out of your deduction while securing top-quality IT equipment for the upcoming year.

Speak to Ubisec to find out how your business can get the best benefits from the Section 179 tax deduction.

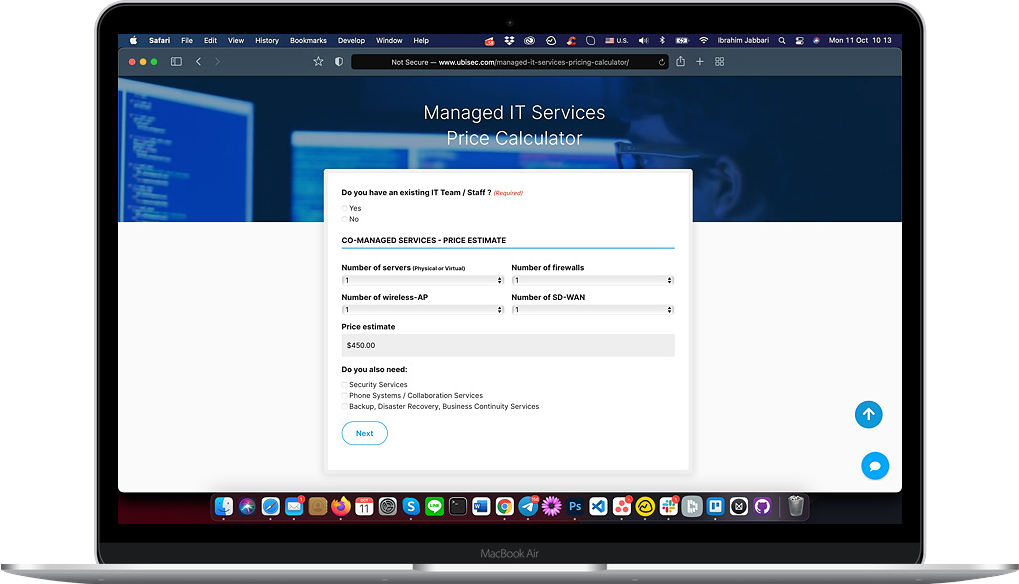

Interested to know the average cost of co-managed or fully managed IT services? Try out our MSP price calculator and get an estimate.

Frequently Asked Questions

Section 179 determination is subject to a few limitations. You can deduct up to $1,160,000 in qualified property in 2023. If you spend more than $2,890,000 on qualified property, your deduction will be decreased dollar for dollar.

Computers and computer software depreciate at a rate of 40%. That is, while determining taxable business income, the assessee can claim a 40% depreciation deduction on computers and computer software.

Yes, you can deduct software license costs under Section 179 if it qualifies as eligible property, like off-the-shelf software, meeting specific usage and useful life criteria.

To ensure compliance and maximize benefits, keep detailed purchase records, consult a tax advisor, and strategically plan acquisitions to optimize deduction limits.

Section 179 can improve cash flow by allowing upfront deductions, reducing taxable income, and providing immediate tax savings, but timing expenditures strategically is essential for maximum cash flow benefits.